Are California corporations shirking their fair share in property taxes? A CTA-backed initiative that has qualified for the November 2020 ballot will allow voters to weigh in, and potentially close a loophole that has kept corporate property taxes artificially low and starved public schools and other vital services of billions of dollars for decades.

The ballot measure, named the California Schools and Local Communities Funding Act (CSLCFA), changes 1978’s Proposition 13, which capped property tax rates at 1 percent of their 1976 value and limited inflation increases to 1 percent annually. Those low rates are locked in until a property changes ownership (or undergoes reconstruction), when it can be reassessed at current market value. The passage of Prop. 13 devastated school funding, propelling California’s rapid decline from near the top to near the bottom nationally in per-pupil funding.

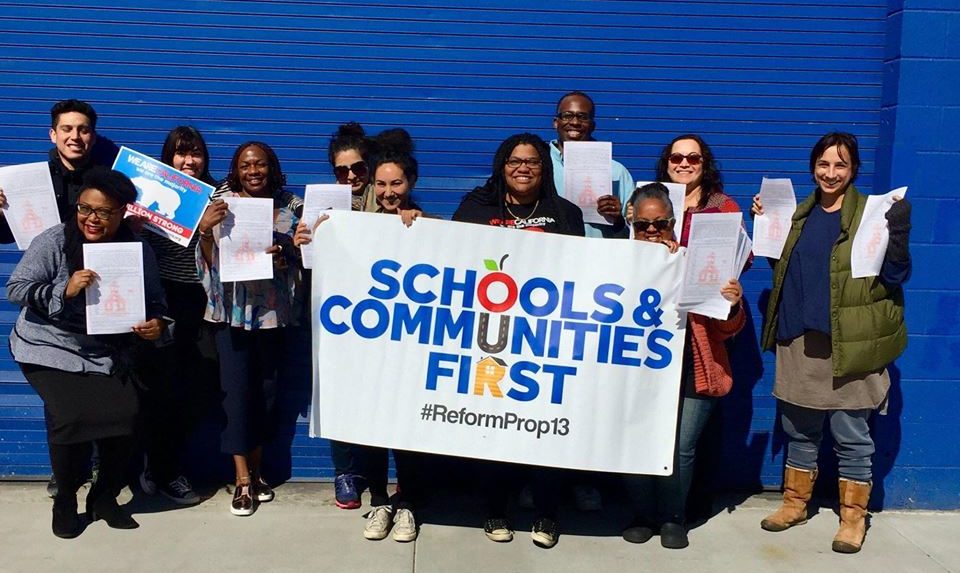

The CSLCFA, also known as the Schools and Communities First initiative, will be the first measure to modify Prop. 13 (often called the “third rail of California politics”) put before voters in the four decades since the problematic initiative was passed. Crafters of the measure have taken care to guarantee existing protections for homeowners, and have carved out exemptions for agricultural property. It also helps out smaller businesses by exempting them from reassessment until they are sold, and eliminating current taxes on fixtures and equipment.

“ We’re talking about billions of dollars lining the pockets of corporations that should be going to help California students. This initiative is fair and long overdue.” — CTA President Eric C. Heins

If passed, the measure would provide an estimated $11 billion a year for K-12 schools, community colleges and local servicessuch as health clinics, trauma care and emergency rooms, parks, libraries, and public safety.

“We’re talking about billions of dollars lining the pockets of corporations that should be going to help California students,” says CTA President Eric C. Heins. “This initiative is fair and long overdue.”

The original intent of Prop. 13 was ostensibly to protect homeowners, especially seniors on fixed incomes, from being taxed out of homes they had bought years before. However, by far the greatest benefit has gone to corporations, which in many cases have paid ridiculously low rates on long-held properties.

In 2008, when Anheuser-Busch was purchased by multinational brewer InBev, its 3 million-square foot Van Nuys brewery property wa being taxed at $18,000 annually, or less than a penny per square foot. If taxed at then-current values, the tax bill for the land alone should have been over $1.3 million.

To compound the problem, many corporations have gamed the system during property purchases through various means, including ensuring that no single purchaser owns more than 50 percent. In 2002, for example, wine company Gallo purchased 1,765 acres of vineyards in Nap and Sonoma, but avoided a reassessment because 12 Gallo family members obtained individual minority interests in the sale.

While it’s certain that the measure will face fierce and wellfunded opposition by corporations and business-friendly taxpayer groups, proponents argue the measure will simply place California on par with how the vast majority of states treat commercial property by assessing them at fair market value. This initiative would only affect undervalued commercial properties, creating a level playing field for those businesses that already pay their fair share.

CTA is joined by dozens of education groups, school boards, housing advocates, small businesses, social justice groups and other labor i supporting the measure.

“We’ll be working in the coming year to ensure both CTA members and the general public are clear about what this initiative will do and how much it will benefit California public schools,” said Heins. “As the #RedForEd movement has raised awareness of the chronic underfunding of our schools, the time is right for this initiative to help reverse that trend.”

For more on the CSLCFA and on tax fairness, visit the campaign website at School and Communities First and CTA Tax Fairness.

Details, Details

The California Schools and Local Communities Funding Act:

- Restores over $11 billion a year for services that all Californians rely on like schools and community colleges. Out of this revenue, $4.5 billion will support K-12 education and community colleges, and the remainder will be shared by counties, cities and special districts to support community services, including health clinics, trauma care and emergency rooms, parks, libraries and public safety.

- Benefits small businesses by exempting owner-operated small businesses from reassessment until they are sold; leveling the playing field so small businesses can compete more fairly with big corporations; and reducing their taxes by eliminating the property tax on fixtures and equipment.

- Mandates full transparency and accountability for all revenue restored to California from closing the commercial property tax loophole.

Endorsers

CSLCFA endorsers include education, labor, housing, health, and social and environmental justice groups, as well as individuals and elected officials.

Here is a partial list; for the full list, and to get involved, see School and Communities First.

CTA/NEA

Common Sense Kids Action

California Federation of Teachers

American Federation of Teachers

League of Women Voters of California

California State PTA

SEIU California

The Discussion 0 comments Post a Comment