Razi with her dog Molly Grace.

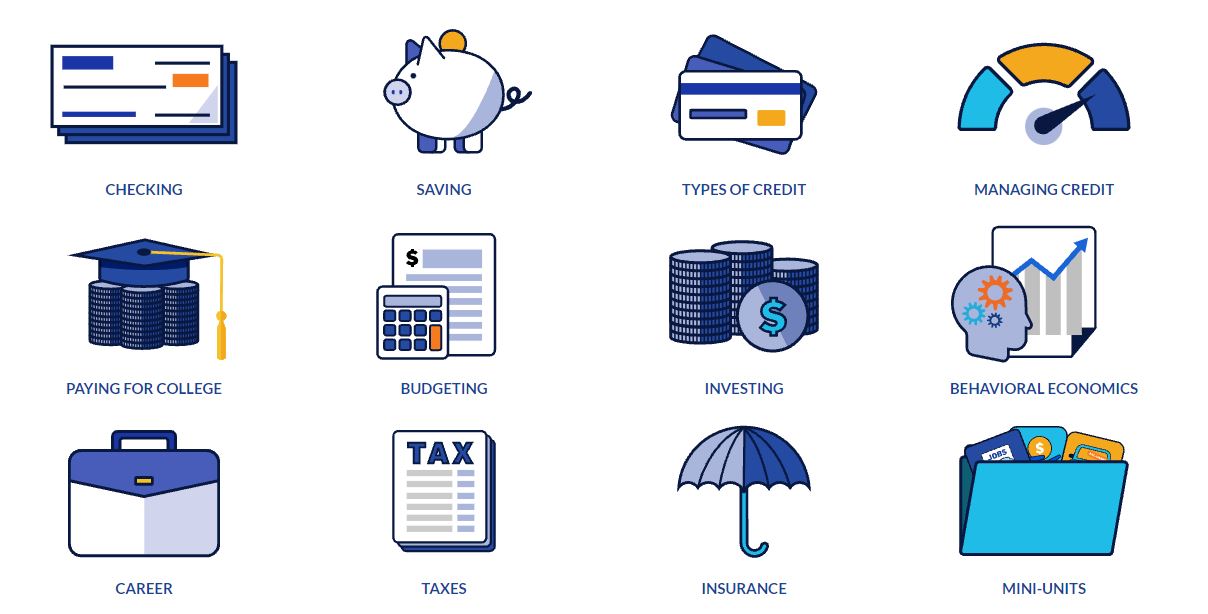

Personal Finance — including such basics as keeping checking and savings accounts, establishing and managing credit, and paying taxes — is arguably one of the most important things young people need to know before launching into adulthood. But currently only a quarter of California high school students even have the choice of taking a personal finance course.

Tara Razi is doing her part to change that. The social science teacher at San Marcos High School in North San Diego County spent her summer creating a yearlong personal finance course meeting UC and CSU “a-g” admission requirements, which proved to be so popular this fall that another instructor and more sections were quickly added.

In addition to her own work, Razi’s class uses content from Next Gen Personal Finance (ngpf.org), which provides curriculum and other resources for educators.

“I want to help teach seniors and juniors the real-life skills they need to be successful in a post-high school world,” explains Razi, a member of San Marcos Educators Association (SMEA) in her eighth year of teaching.

The course also addresses budgeting, investing, financial pitfalls and ethics. It takes students through a real process of applying for a job (writing a creative résumé and cover letter, building a career portfolio, interviewing with an employer, sending thank-you notes). “They don’t have to take the job; that’s not the purpose,” Razi says.

“We need this class — truly, it should be a graduation requirement.”

—Tara Razi, San Marcos Educators Association

Students start the course with two weeks of “executive development” where they must email all their teachers, introduce themselves, and talk about their strengths and where they might need support. They learn critical organizational and time-management skills.

Guest speakers from the community add further relevance to the lessons. Razi, who says she has always been financially responsible and taught herself important skills from others’ mistakes, developed her curriculum based on her own work and content at Next Gen Personal Finance (ngpf.org), which provides curriculum and other resources for educators. She also consulted with The San Marcos Promise, a nonprofit foundation serving students in the San Marcos Unified School District with programs and resources throughout their education and into employment. It was helpful that the district’s other high school had started a similar course last year, taught by SMEA member Jeff Montooth.

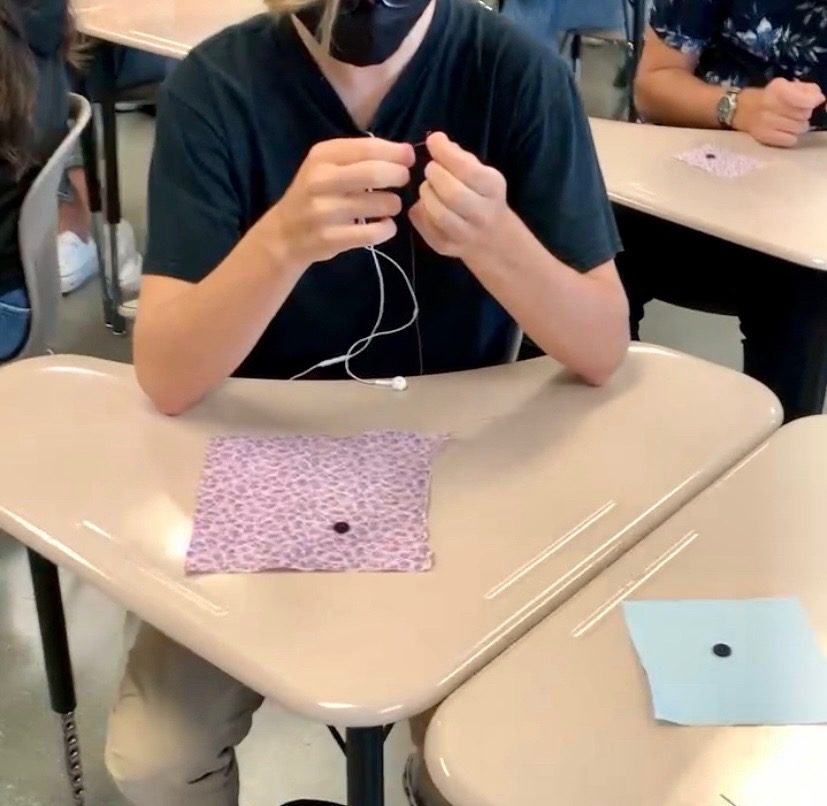

Razi teaches many skills that go way beyond understanding money or planning a career, such as how to sew a button.

It doesn’t surprise Razi that the course is in such demand, with a waiting list in addition to six sections. “We need this class — truly, it should be a graduation requirement.” She now teaches three personal finance courses as well as three U.S. history courses. While that keeps her busy, she finds the time to keep and train two therapy dogs, run triathlons and marathons, and head up her school site council, the football team snack bar and the social committee.

Such multitasking, of course, extends to the personal finance class. Razi teaches many skills that go way beyond understanding money or planning a career. “A postal service worker came to talk about how to address envelopes, which many students did not know. They learn to sew buttons! I talk to them about price-matching in stores and how to get it. They find out what to do in a car accident, how to go through insurance claims, how to leave a voicemail.”

Invaluable life hacks — what students (and all of us) need.

The Discussion 0 comments Post a Comment