LIKE MOST EDUCATORS, you’re super busy juggling school and teaching with life on the home front. You barely have time to think about dinner, much less what’s coming up 10, 20, 30 years from now.

So when you start getting emails or calls from financial firms mentioning they have the perfect plan for your retirement savings, you think sure, one less thing to worry about — sign me up now.

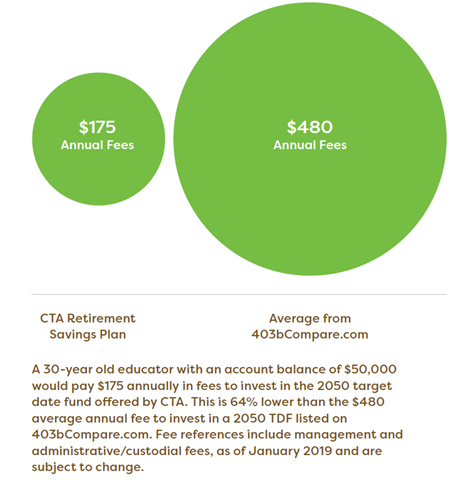

But hold on! Many plans offered by outside vendors end up charging high fees and commissions over time that can add up to thousands of dollars of your hard-earned money. And about 70 percent of these plans include surrender fees that lock up your savings.

To help you build a secure financial future and avoid such predatory tactics, CTA has developed a custom 403(b) Retirement Savings Plan (RSP) for members. The plan has low fees, and there are no commissions or surrender charges.

CTA oversees the plan, built specifically for educators, and partners with service providers that have been vetted for quality and service. As with all 403(b) plans, CTA’s RSP is available through your district as your contributions are deducted from your paycheck.

“You spend your career helping students plan for their future,” says CTA President E. Toby Boyd. “CTA wants to help you plan for yours. We think every California teacher has the right to a high-quality, low-cost retirement plan.”

Employees of nonprofits like schools can participate in 403(b) plans to save money for retirement. Most educators don’t qualify for Social Security benefits, and CalSTRS and CalPERS pensions potentially only cover a part of what is needed during retirement, so saving in a 403(b) is important.

Currently, over a thousand educators participate in CTA’s RSP. Some moved funds from a former 403(b) to the RSP to save on fees, and others started in the plan as new savers.

CalSTRS 403(b) Income for

and + Savings = when you

CalPERS stop workingBecause your CalSTRS or CalPERS pension will cover only about a third to a half of the income you will need in retirement, CTA has created a retirement savings plan to help make up the difference.

CTA’s Retirement Savings Plan includes:

• High-quality investments monitored by RVK, one of the largest independent and employee-owned investment consulting firms in the country. Many investments offered are institutionally priced (reserved for large investors versus an individual retail price). RVK reviews each fund’s performance, fees and stability. RVK also has a “no conflicts of interest” business model where their only revenue comes from their clients (CTA in this case).

• No commissions or commissioned salespeople. All plan representatives and enrollment support professionals offered through Prudent Investor Advisors are salaried.

• Responsibility. CTA follows fiduciary standards that ensure all recommendations and decisions are made solely in your best interest. CTA, RVK and Prudent act as fiduciaries, meaning you may not need to spend money on a financial adviser to help manage your retirement plan.

• Low transparent fees. There are no hidden fees, and the plan is designed to keep administrative and investment

management costs low.

• CTA endorsement. The plan is the only one that is built for and endorsed by CTA.

There are two ways to select and manage your investments:

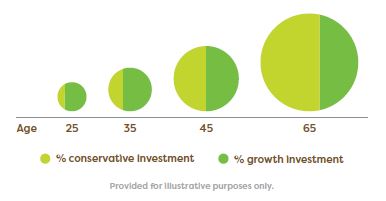

1. Through a target date fund, which corresponds to your age and planned retirement date, and automatically adjusts downward the level of risk being taken on that timeline over time. BlackRock, the world’s largest money manager, is the target date fund provider.

The target date fund is a mix of investments that is selected by professionals. As your planned retirement date gets nearer, the fund’s mix of investments automatically adjusts. It favors growth (more stocks) in the early years, and becomes more conservative (more bonds and income funds) as you near retirement. Using a BlackRock target date fund means you don’t have to worry about diversifying and rebalancing your portfolio; it’s all done for you.

How a Target Date Fund Works

You spend your career helping students plan for their future. CTA wants to help you plan for yours. We think every California teacher has the right to a high-quality, low-cost retirement plan.”

— CTA President E. Toby Boyd

2. You select and manage investments yourself based on a handful of options (generally invested through low-cost index funds) across the equity and fixed income spectrum.

There’s no minimum amount required to start the plan. And you can opt into or out of any fund as you please.

CTA wants you to have a long and happy retirement and is here to help on your journey to financial security. Contact the CTA Enrollment Center at 916‑235‑9800 or at enroll.ctaretirementplan.org for more information and to get started with the Retirement Savings Plan. In addition, you can watch a video about the plan with CTA President E. Toby Boyd at ctainvest.org/the-buzz, and find details as well as personal finance tools and investment news at CTAinvest.org.

“ I appreciated the clear and easy presentation. It seemed like a better deal, so I switched.”

— Kellyn Griffin, Porterville Educators Association

CTA MEMBERS WHO have made the switch to CTA’s Retirement Savings Plan say they like what it offers them — especially lower fees and transparency. A few examples:

1. Kellyn Griffin, a member of Porterville Educators Association, is now in her ninth year of teaching. Soon after starting her first teaching job in Madera, co-workers told her, “You need to sign up for a 403(b), and you need to do it soon.”

1. Kellyn Griffin, a member of Porterville Educators Association, is now in her ninth year of teaching. Soon after starting her first teaching job in Madera, co-workers told her, “You need to sign up for a 403(b), and you need to do it soon.”

The high school earth and space science teacher knows she’s lucky she got the advice. “I’m a science person — it’s not in my brain to know about 403(b)s,” she laughs. “I would have to do a lot of my own research, so I rely on other people.” Griffin has managed to save a substantial amount in the past years. But she was invested in a variable annuity product and realized she would be charged steep fees for withdrawing down the line.

Last year she attended a districtwide presentation on CTA’s RSP. “I appreciated the clear and easy presentation. It seemed like a better deal, so I switched.”

Fortunately, she had been with the other plan long enough that there was no surrender fee to roll over her funds to the CTA RSP. She’s now invested in a target date fund that aligns with her year of birth. It’s estimated that she’ll save 68 percent annually in ongoing administrative and investment fees compared to her former funding option, using the CTA RSP’s largely flat administrative and custodial fees.

2. Larry Johnson, now in his 37th year as an educator, has enjoyed teaching subjects as varied as

2. Larry Johnson, now in his 37th year as an educator, has enjoyed teaching subjects as varied as

math, technology and alternative PE, but is looking forward to retirement in spring 2021. The Visalia Unified Teachers Association member has served on CTA State Council’s retirement committee for the past six years, where he got an early peek at CTA’s RSP.

“I’ve been hearing about the RSP program being set up to bridge the gap between high-fee annuities and the CalSTRS pension,” he says. “CTA began rolling out retirement seminars at their conferences. I went to one last winter and found out that my 30-year-old variable annuity was one of the worst.”

Johnson says that when he first looked into 403(b)s years ago, there were no other options available. After he and his wife Sandy, a longtime kindergarten teacher, attended the seminar, they decided to “jump ship” and transfer to the CTA RSP this past summer.

“You put $100 a month away, do it for 20 years, that’s going to be a huge shift in what you have available to you. CTA products are set up to perform and not take things out at the end.”

“You put $100 a month away, do it for 20 years, that’s going to be a huge shift in what you have available to you. CTA products are set up to perform and not take things out at the end.”

—Larry Johnson, Visalia Unified Teachers Association

He is now estimated to be saving almost $3,000, or more than 90 percent, in ongoing administrative and investment fees annually compared to what he had before.

His son Ian is also an educator, teaching high school geology. Johnson urged him to start his 403(b) as soon as he began his career. “You put $100 a month away, do it for 20 years, that’s going to be a huge shift in what you have available to you. CTA products are set up to perform and not take things out at the end.”

Get Your Plan Reviewed at No Cost

IF YOU ALREADY have a retirement plan, make sure you’re not being taken advantage of. CTA offers a free review and comparison of your current plan with CTA’s Retirement Savings Plan. To request a review, go to review.ctaretirementplan.org.

Opportunities to spend less on administrative and investment fees and save more for your retirement vary based on your individual circumstances, but they can be very meaningful. A recent fiduciary review of approximately 100 CTA members who are not in the CTA RSP indicates that they would save in excess of 50 percent on annual expenses.

Don’t know what type of plan you have? Call our enrollment team at 916‑235‑9800 for help.

Already Have a Plan? Ask This

MAKE SURE you’re in a retirement plan that does not charge you excessive fees and is transparent in how it operates.

Start by getting answers to these important questions. To do this, call the company managing your plan. (Find their phone number on your statement or their website.)

- What type of plan do I have?

- How much are you charging me in total fees? Can you break down those fees for me?

- Where is my money being invested?

- Are there surrender or early withdrawal fees on my investments.

Pay Attention to Fees